Fill Your Citibank Direct Deposit Form

For individuals looking to streamline their banking experience, the Citibank Direct Deposit form plays a crucial role in ensuring timely and secure access to funds. This form allows account holders to authorize the automatic deposit of their paychecks, government benefits, and other recurring payments directly into their Citibank accounts. By completing the form, users provide essential information, including their account number and routing number, which facilitates the seamless transfer of funds. Additionally, the form typically requires the account holder's signature, confirming their consent to initiate direct deposits. Understanding the implications of this form can empower individuals to manage their finances more effectively, ensuring that funds are available when needed without the hassle of manual deposits. With the convenience of direct deposit, account holders can enjoy peace of mind, knowing that their payments will be deposited safely and reliably, enhancing their overall banking experience.

More PDF Templates

Free Doctors Note - It reinforces the need for reasonable accommodations for those with documented medical conditions.

High School Transcript - Used to facilitate academic advising and course selection for further education.

In order to fulfill the requirements set by the state, individuals must obtain the FR-44 Florida form to prove adequate insurance coverage, and for more detailed information on this process, you can visit Florida Forms, which provides essential resources for understanding and completing the necessary documentation.

Army Da31 - The form requires the dates for both requesting and returning from leave.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Citibank Direct Deposit form is used to authorize automatic deposits into a bank account. |

| Eligibility | Individuals with a Citibank account can use this form for direct deposit setup. |

| Information Required | The form requires personal information, including name, address, account number, and routing number. |

| Submission Method | Completed forms can typically be submitted online, by mail, or in person at a Citibank branch. |

| Processing Time | Direct deposits generally take one to two pay cycles to start after the form is submitted. |

| State-Specific Laws | In some states, specific regulations may apply to direct deposit agreements, such as California Labor Code Section 213. |

| Cancellation | Customers can cancel direct deposit by submitting a new form indicating the change or by contacting customer service. |

| Security | The form includes safeguards to protect sensitive information, ensuring secure handling of personal data. |

How to Write Citibank Direct Deposit

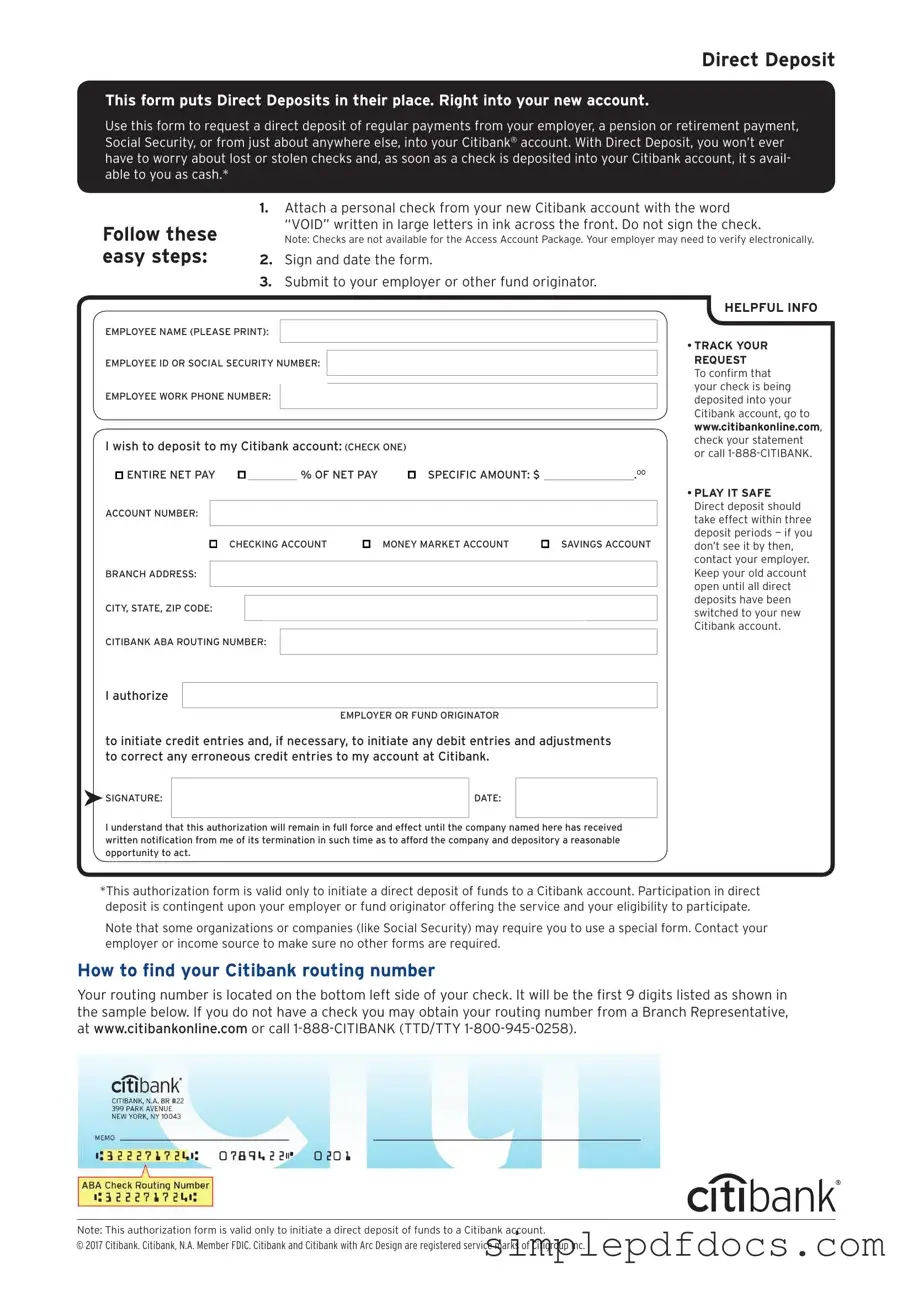

After obtaining the Citibank Direct Deposit form, you will be required to provide specific information to ensure that your direct deposit is set up correctly. This process involves filling out your personal details, bank information, and authorization for the deposit. Follow the steps outlined below to complete the form accurately.

- Begin by entering your full name in the designated section at the top of the form.

- Next, provide your Social Security Number (SSN). This is essential for identification purposes.

- Fill in your current address, including street, city, state, and ZIP code.

- Locate the section for bank information. Here, you will need to write the name of your bank.

- Input your bank account number. Be careful to enter this accurately, as errors can lead to delays.

- Indicate whether your account is a checking or savings account by marking the appropriate box.

- Provide the bank’s routing number. This number is typically found on your checks or can be obtained from your bank's website.

- Read the authorization statement carefully. By signing the form, you agree to the terms outlined.

- Sign and date the form at the bottom to complete your submission.

Once you have filled out the form, it is important to double-check all entries for accuracy. After ensuring that everything is correct, submit the form to your employer or the designated department handling payroll. This will initiate the process for setting up your direct deposit.

Dos and Don'ts

When filling out the Citibank Direct Deposit form, follow these guidelines to ensure accuracy and efficiency.

- Do: Provide accurate personal information, including your name and address.

- Do: Use the correct account number for your checking or savings account.

- Do: Double-check the routing number for your bank.

- Do: Sign and date the form to validate your request.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank.

- Don't: Use an outdated version of the form.

- Don't: Provide incorrect or outdated banking information.

- Don't: Forget to notify your employer of any changes to your banking information.

Documents used along the form

When setting up a direct deposit with Citibank, there are several other forms and documents that may be required to ensure a smooth process. Each of these documents serves a specific purpose and can help facilitate the transfer of funds directly into your bank account. Below is a list of commonly used forms and documents associated with the Citibank Direct Deposit form.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax withheld from each paycheck. Completing this form accurately ensures that the correct amount is deposited after taxes are deducted.

- Bank Account Verification Letter: Often provided by the bank, this letter confirms the account holder's details, including account number and routing number. It serves as proof that the account is valid and can receive direct deposits.

- Georgia Trailer Bill of Sale Form: When transferring ownership of a trailer, it's important to utilize the detailed Georgia Trailer Bill of Sale resources to ensure compliance and protection for both parties involved.

- Employer Direct Deposit Authorization Form: This document is typically provided by the employer and grants permission for the employer to deposit wages directly into the employee's bank account. It often includes necessary details such as the employee's name, account number, and bank information.

- Pay Stub: A pay stub is a document provided by the employer that outlines the employee's earnings and deductions for a specific pay period. It may be required for verification purposes to ensure the correct amount is deposited.

Each of these documents plays a crucial role in the direct deposit process. By ensuring that all necessary forms are completed and submitted accurately, individuals can enjoy the convenience of having their funds deposited directly into their accounts without unnecessary delays.