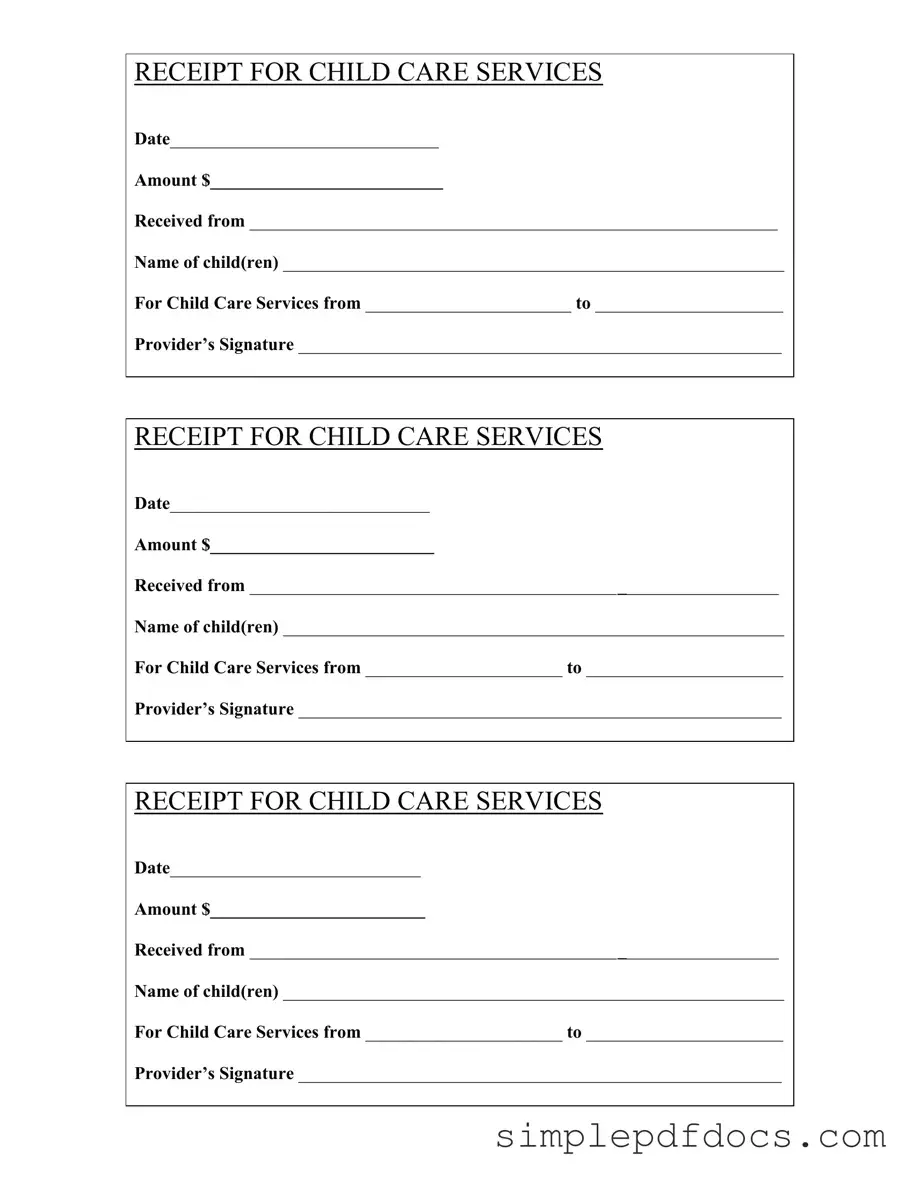

Fill Your Childcare Receipt Form

The Childcare Receipt form is an essential document for parents and childcare providers alike. It serves as proof of payment for childcare services rendered, ensuring transparency in financial transactions. Each receipt includes crucial details such as the date of payment, the amount received, and the name of the child or children receiving care. Additionally, it specifies the period during which the services were provided, offering clarity for both parties. The provider's signature at the bottom of the form confirms that the transaction has been completed. This form not only helps parents keep track of their childcare expenses for budgeting purposes but also supports providers in maintaining accurate financial records. Understanding how to properly fill out and utilize this form can significantly streamline the childcare payment process and ensure compliance with any relevant tax regulations.

More PDF Templates

P-45 - Incorrect information could delay tax processing for the employee.

Understanding the importance of an RV Bill of Sale form is vital for any transaction involving a recreational vehicle. This document not only acts as a legal receipt for the sale but also outlines crucial information regarding the vehicle. To learn more about the specifics of this form, explore our guide on the comprehensive RV Bill of Sale regulations available here.

Cash Received Receipt - Essential for non-profit organizations receiving donations.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Childcare Receipt form serves as a record of payment for childcare services, ensuring transparency between providers and parents. |

| Date Requirement | Each receipt must include the date of payment, which helps in tracking financial transactions for both parents and providers. |

| Amount Specification | The form requires the total amount paid for services, allowing parents to maintain accurate financial records and potentially claim tax deductions. |

| Provider Information | Providers must sign the receipt, confirming that they received the specified amount for the childcare services rendered. |

| Child Identification | Names of the child or children receiving care must be included, which ensures clarity and accountability in childcare services. |

| Service Dates | The form specifies the period during which childcare services were provided, aiding in verifying the duration of care and payment. |

| State-Specific Regulations | In some states, such as California, the Childcare Receipt form is governed by the California Family Code, which outlines the legal requirements for childcare agreements. |

How to Write Childcare Receipt

Completing the Childcare Receipt form is straightforward and essential for documenting childcare services. Follow these steps to ensure all necessary information is accurately filled out.

- Locate the Date field at the top of the form and enter the date when the payment was made.

- In the Amount field, write the total amount paid for childcare services.

- Find the Received from section and fill in the name of the person making the payment.

- In the Name of child(ren) field, list the names of the children receiving care.

- In the For Child Care Services from section, indicate the start date of the childcare services.

- In the to field, specify the end date of the childcare services.

- Finally, the provider should sign in the Provider’s Signature area to validate the receipt.

Dos and Don'ts

When filling out the Childcare Receipt form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do write the date clearly to avoid confusion.

- Do fill in the amount accurately, ensuring it matches the payment received.

- Do include the full name of the person making the payment.

- Do list the names of all children receiving care to ensure proper documentation.

- Don't leave any fields blank; incomplete forms can lead to issues later.

- Don't forget to sign the form; a signature is essential for validation.

- Don't use abbreviations or nicknames; clarity is key for official records.

By following these guidelines, you can ensure that the Childcare Receipt form is filled out correctly and efficiently. This not only helps maintain accurate records but also protects you and the childcare provider in case of any disputes or inquiries in the future.

Documents used along the form

The Childcare Receipt form is an essential document for parents and caregivers to track payments for childcare services. However, several other forms and documents often accompany it to ensure proper record-keeping and compliance with tax regulations. Below is a list of these related documents.

- Childcare Agreement: This document outlines the terms and conditions of the childcare services provided. It includes details such as hours of operation, payment terms, and the responsibilities of both the provider and the parent.

- Florida Traffic Crash Report: The Florida Forms provide essential resources for drivers involved in accidents, ensuring they accurately report incidents to comply with state regulations and assist in insurance claims.

- Emergency Contact Form: This form provides essential information about whom to contact in case of an emergency involving the child. It typically includes names, phone numbers, and relationships to the child.

- Health and Immunization Records: These records document a child's health history and vaccination status. They are often required by childcare providers to ensure the safety and health of all children in their care.

- Tax Identification Number (TIN) Form: This form is necessary for tax purposes. It allows the childcare provider to report income received from childcare services and helps parents claim childcare expenses on their taxes.

- Parent Handbook: This document provides parents with important information about the childcare facility, including policies, procedures, and expectations. It serves as a guide for parents to understand how the facility operates.

These documents work together with the Childcare Receipt form to create a comprehensive framework for managing childcare services. Keeping these forms organized can help ensure a smooth experience for both parents and providers.