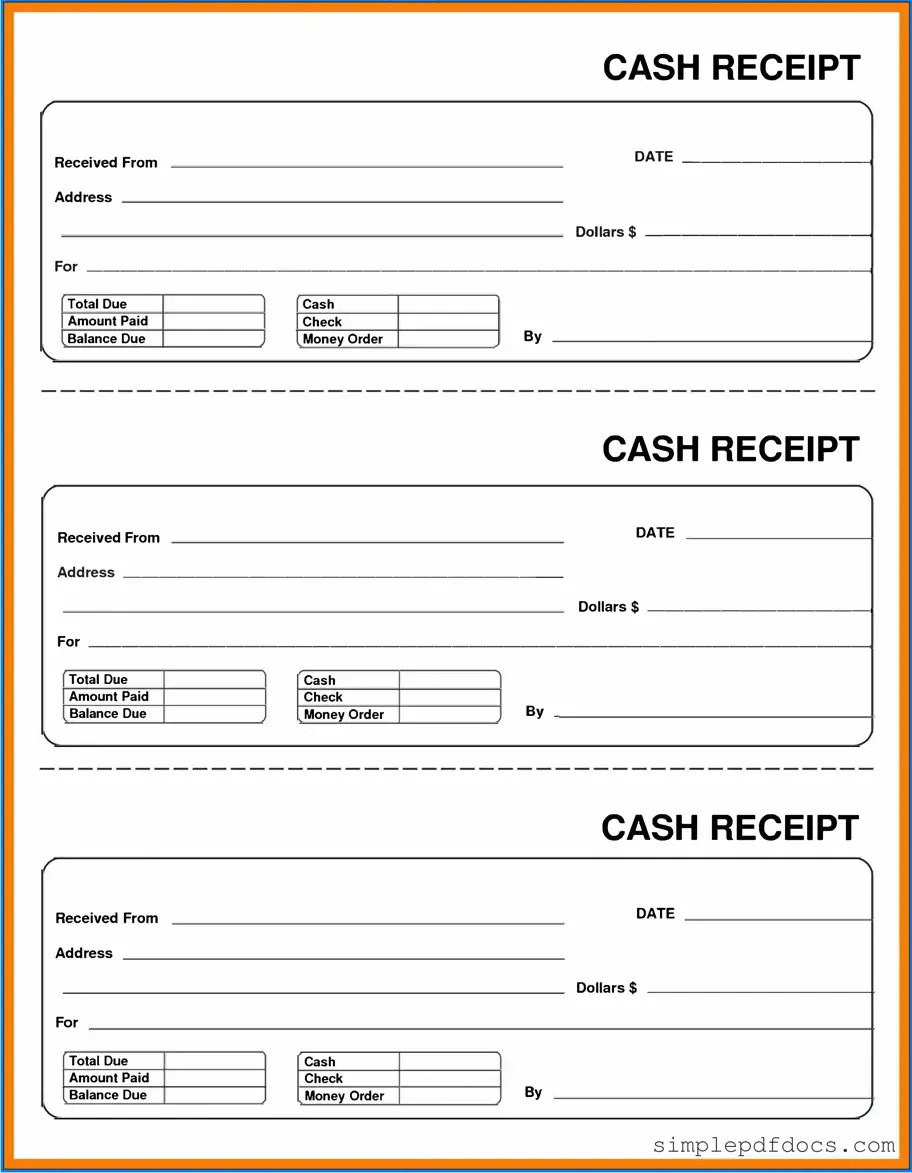

Fill Your Cash Receipt Form

The Cash Receipt form is an essential tool for businesses and individuals alike, serving as a formal record of cash transactions. This document captures vital details such as the date of the transaction, the amount received, and the purpose of the payment. It typically includes information about the payer, ensuring transparency and accountability in financial dealings. By providing a clear and organized way to document cash inflows, the Cash Receipt form helps maintain accurate financial records and simplifies accounting processes. Whether used in retail, service industries, or personal transactions, this form plays a crucial role in tracking income and managing finances effectively. Proper use of the Cash Receipt form can also aid in resolving disputes and providing proof of payment when necessary.

More PDF Templates

Da - It assists in readiness assessments for military operations.

For those interested in securing their tractor transactions, understanding the requirements of a reliable Tractor Bill of Sale can prove invaluable. This document not only protects both parties involved but also simplifies the process of ownership transfer. To learn more, visit our informative page on the necessary Tractor Bill of Sale form details.

Acord 130 - A workspace for listing additional coverages or endorsements is available for further elaboration.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document cash transactions, ensuring accurate record-keeping for both businesses and customers. |

| Components | This form typically includes fields for the date, amount received, payer information, and the purpose of the payment. |

| Legal Requirements | In many states, maintaining accurate cash receipts is governed by tax laws, which require businesses to keep records for a specific number of years. |

| Importance | Using a Cash Receipt form helps prevent disputes over payments and provides a clear trail for auditing and financial management. |

How to Write Cash Receipt

Filling out the Cash Receipt form is an important step in keeping accurate financial records. Once you have completed the form, it will be processed accordingly, ensuring that all transactions are documented properly. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date of the transaction in the designated space.

- Write down the name of the person or organization making the payment.

- Specify the amount received in the appropriate field. Make sure to double-check the figures.

- Indicate the method of payment, such as cash, check, or credit card.

- Provide a brief description of the purpose of the payment.

- Sign and date the form at the bottom to confirm the transaction.

Dos and Don'ts

When filling out the Cash Receipt form, keep these tips in mind to ensure accuracy and compliance.

- Do: Write legibly to avoid any confusion.

- Do: Double-check all amounts before submitting.

- Do: Use the correct date to reflect the transaction accurately.

- Do: Include all necessary details such as the payer's name and purpose of payment.

- Don't: Leave any required fields blank.

- Don't: Use correction fluid or tape on the form; it can cause issues with processing.

Documents used along the form

The Cash Receipt form is an essential document in financial transactions, serving as proof of payment received. However, several other forms and documents often accompany it to ensure accurate record-keeping and compliance. Below is a list of related documents that play a vital role in the financial process.

- Invoice: This document details the goods or services provided, along with their prices. It serves as a request for payment from the buyer to the seller.

- Payment Voucher: A payment voucher outlines the specifics of a payment, including the amount and the purpose. It is often used to authorize the payment process.

- Deposit Slip: This slip is used when depositing cash or checks into a bank account. It records the amount being deposited and provides a receipt for the transaction.

- Bank Statement: A bank statement summarizes all transactions in a bank account over a specific period. It helps in reconciling cash receipts with actual bank deposits.

- Vehicle Power of Attorney: If you're unable to manage your vehicle-related tasks due to time constraints or other reasons, you can use the Florida Forms to appoint someone to handle these transactions on your behalf, ensuring they're done legally and efficiently.

- Sales Receipt: Similar to a cash receipt, a sales receipt confirms that a sale has occurred. It usually includes details about the transaction, such as date, items purchased, and payment method.

- Credit Memo: A credit memo is issued to a customer to reduce the amount they owe. It might be used in cases of returns or discounts, adjusting the original invoice amount.

Each of these documents plays a crucial role in maintaining clear and accurate financial records. Together, they help ensure transparency and accountability in financial transactions.