Fill Your Cash Drawer Count Sheet Form

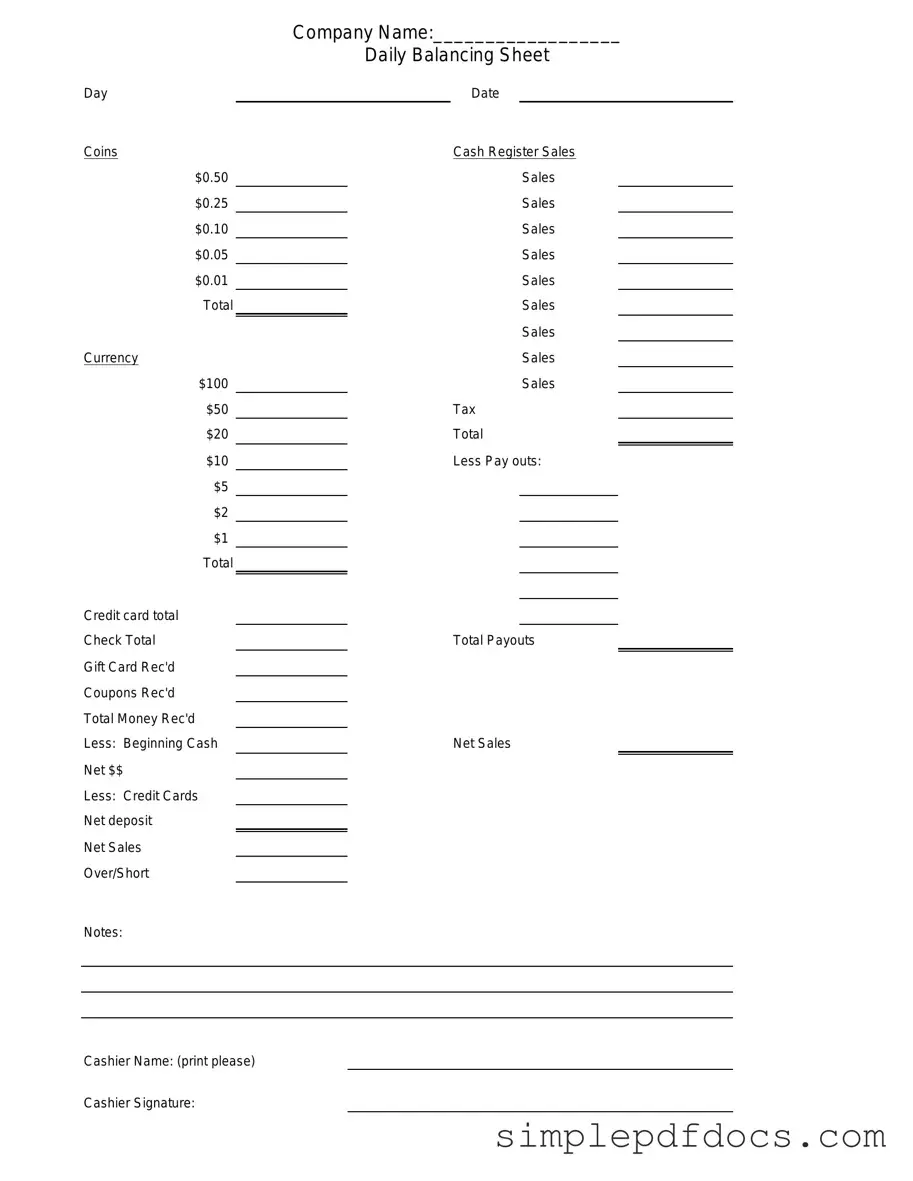

The Cash Drawer Count Sheet form plays a crucial role in the management of cash transactions within a business. This form serves as a detailed record for tracking the cash flow in and out of a cash drawer, ensuring accuracy and accountability. By documenting the starting cash balance, the total cash received, and the cash paid out, it allows businesses to reconcile their cash at the end of each shift or day. Additionally, the form typically includes sections for noting discrepancies, which can help identify potential issues or errors in cash handling. This systematic approach not only aids in maintaining financial integrity but also enhances operational efficiency. With the right use of the Cash Drawer Count Sheet, businesses can foster a culture of transparency and trust, both among employees and with customers.

More PDF Templates

Form I-134 - Providing comprehensive proof of income can increase the likelihood of approval.

A Florida Quitclaim Deed form is a legal document used to transfer interest in real estate with no guarantees about the title. It's commonly employed between family members or close acquaintances when the property is not being sold for its full market value. This form simplifies the process, making it faster and more straightforward to shift ownership. For those looking to utilize this form, you can find it at floridaforms.net/blank-quitclaim-deed-form.

Stillborn Birth Certificate - The Miscarriage Discharge Paper is a vital tool in managing the aftermath of loss.

14653 Form - The form aims to assist taxpayers in rectifying previous compliance lapses effectively.

Document Specifics

| Fact Name | Detail |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to document the cash on hand in a business's cash drawer at the beginning and end of a shift or business day. |

| Components | This form typically includes fields for recording the starting cash amount, cash sales, cash received, and the ending cash balance. |

| Importance | Accurate completion of this form helps prevent theft and errors, ensuring that the cash register balances with sales records. |

| Frequency of Use | It is commonly used daily by businesses that handle cash transactions, such as retail stores and restaurants. |

| Legal Compliance | While there is no federal law mandating its use, many states have regulations requiring businesses to maintain accurate financial records. |

| Record Keeping | Businesses should retain completed Cash Drawer Count Sheets for a specified period, often in line with state tax regulations, to support audits and financial reviews. |

How to Write Cash Drawer Count Sheet

After gathering the necessary cash and receipts, you are ready to complete the Cash Drawer Count Sheet. This form will help ensure accuracy in your cash handling process. Follow the steps below to fill it out correctly.

- Start by entering the date at the top of the form.

- Write your name in the designated section to identify who is completing the count.

- List the starting cash amount in the appropriate field.

- Count the cash in the drawer, including bills and coins, and record the amounts in the respective columns.

- Calculate the total cash amount and write it in the total field.

- Compare the total cash amount to the starting cash amount. Note any discrepancies in the comments section.

- Sign and date the form at the bottom to confirm the count is complete.

Ensure that all information is accurate before submitting the form. This will help maintain accountability and transparency in cash handling procedures.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, it’s important to follow certain guidelines to ensure accuracy and clarity. Here are some things you should and shouldn't do:

- Do double-check the starting cash amount before you begin counting.

- Do count all cash and coins carefully to avoid mistakes.

- Do record the amounts clearly and legibly on the form.

- Do ensure you have the right date and time listed on the form.

- Don't rush through the counting process; take your time.

- Don't forget to include any checks or credit card slips, if applicable.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't submit the form without reviewing it for errors.

Documents used along the form

The Cash Drawer Count Sheet is an essential tool for managing cash transactions and ensuring accurate financial reporting. To complement this form, several other documents are often utilized in financial and retail environments. Below is a list of related forms that help maintain financial integrity and streamline operations.

- Daily Sales Report: This document summarizes total sales for a given day, providing insights into revenue and performance metrics.

- Cash Deposit Slip: Used to record the amount of cash being deposited into a bank, ensuring accurate tracking of cash flow.

- Petty Cash Voucher: This form documents small cash expenditures, helping to manage and track petty cash usage effectively.

- End-of-Day Reconciliation Report: A summary that compares cash on hand to sales, ensuring that all transactions are accounted for and discrepancies are identified.

- Quitclaim Deed Form: A texasformspdf.com/ form is essential for transferring property ownership without warranty, commonly used among family members or for resolving title issues quickly.

- Inventory Count Sheet: This form records the quantity of stock on hand, assisting in inventory management and ensuring accurate stock levels.

- Refund Request Form: Used to document customer requests for refunds, providing a clear process for handling returns and exchanges.

- Employee Cash Handling Policy: A guideline that outlines procedures for employees managing cash, promoting accountability and reducing errors.

- Sales Receipt: A record provided to customers after a transaction, detailing items purchased and payment made, serving as proof of purchase.

Utilizing these documents alongside the Cash Drawer Count Sheet enhances financial accuracy and operational efficiency. It is crucial to implement these forms to ensure smooth cash management processes and maintain trust with customers and stakeholders.