Fill Your California Affidavit of Death of a Trustee Form

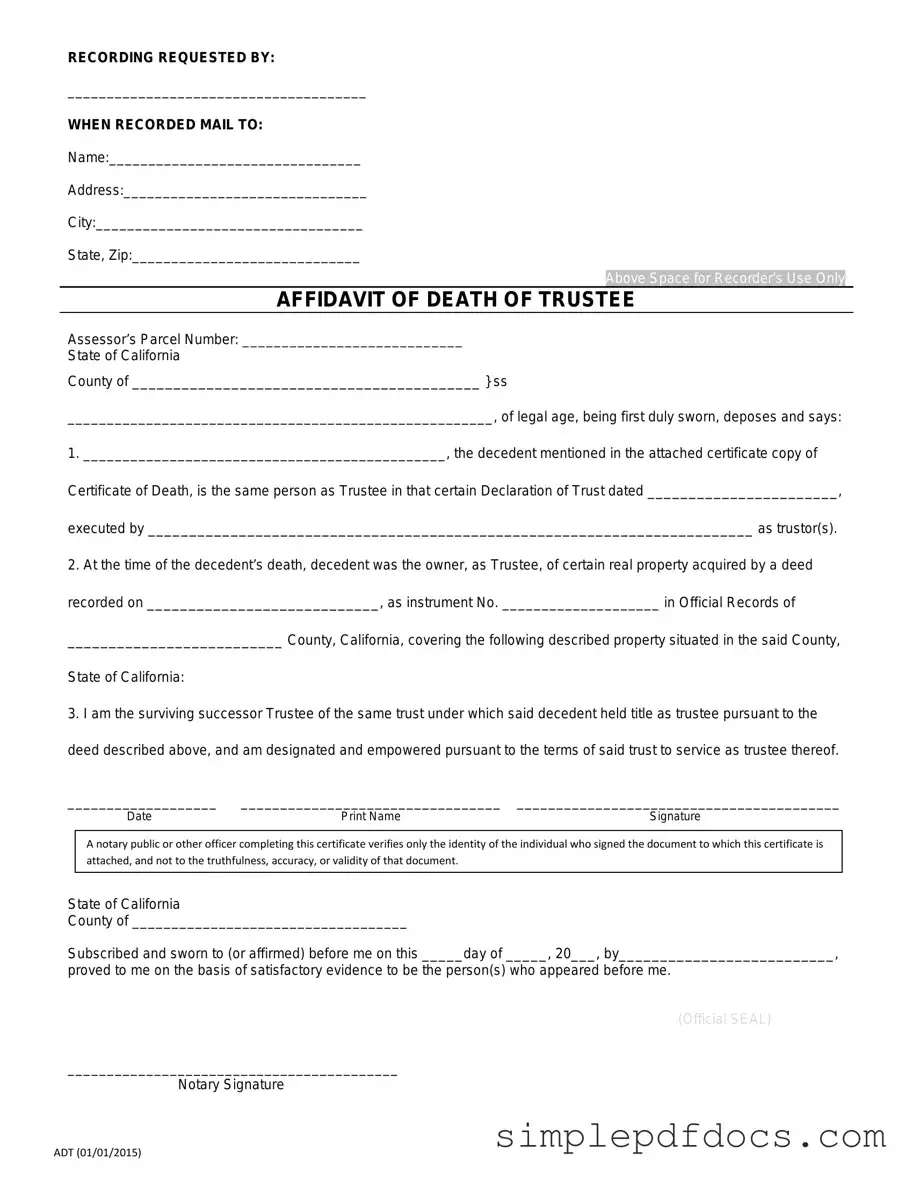

The California Affidavit of Death of a Trustee form serves as a crucial document in the administration of trusts following the death of a trustee. This form is essential for ensuring that the trust can continue to operate smoothly and that the assets can be managed or distributed according to the trust's terms. It typically includes vital information such as the name of the deceased trustee, the date of death, and details about the trust itself. By completing this affidavit, the remaining trustees or beneficiaries can provide legal proof of the trustee's death, which is often necessary for banks, financial institutions, and other entities that manage trust assets. This process not only clarifies the trust's status but also helps in appointing a successor trustee if needed. Understanding the importance of this form can simplify the transition and maintain the integrity of the trust, ensuring that the wishes of the deceased are honored and carried out effectively.

More PDF Templates

How Long Does a Discharge Upgrade Take - Using the DD 149 aids in maintaining integrity in documenting military service.

When navigating the complexities of divorce, having a clear understanding of the Florida Divorce Settlement Agreement is crucial, as it helps define the specific terms both parties have agreed upon. This document not only delineates asset division and child custody arrangements but also outlines support obligations, ensuring that both individuals are protected during this transitional period. For further guidance and resources, you can refer to Florida Forms, which provide valuable information on completing and submitting this form correctly.

How to Terminate Parental Rights in Sc - Affiants are cautioned about the permanence of their decision.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The California Affidavit of Death of a Trustee form is used to formally notify interested parties of a trustee's death, thereby allowing for the proper administration of the trust. |

| Governing Law | This form is governed by the California Probate Code, specifically sections related to trusts and the duties of trustees. |

| Filing Requirements | The completed affidavit must be filed with the county recorder's office where the trust property is located to provide public notice of the trustee's death. |

| Signatures | The affidavit must be signed by the successor trustee or an interested party, affirming the truth of the statements made within the document. |

| Impact on Trust Administration | Once filed, the affidavit allows the successor trustee to assume their role and manage the trust assets, ensuring continuity in trust administration. |

How to Write California Affidavit of Death of a Trustee

After completing the California Affidavit of Death of a Trustee form, the next step involves submitting it to the appropriate county recorder's office. This process helps ensure that the trustee's death is officially recorded, which is essential for the proper administration of the trust.

- Obtain a copy of the California Affidavit of Death of a Trustee form. You can find this form on the California state website or at your local county clerk's office.

- Begin filling out the form by entering the name of the deceased trustee in the designated section.

- Provide the date of death. Ensure this is accurate, as it is a critical piece of information.

- Fill in the name of the trust. This should match the name used in the trust document.

- Include the date the trust was created. This helps establish the timeline of the trust's existence.

- Identify the successor trustee. This is the individual or entity that will take over the trustee's responsibilities.

- Sign the form. The signature must be from the successor trustee or another authorized individual.

- Have the form notarized. A notary public must witness the signature to validate the document.

- Make copies of the completed and notarized form for your records.

- Submit the original form to the county recorder's office in the county where the trust is located.

Dos and Don'ts

When filling out the California Affidavit of Death of a Trustee form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are some key dos and don'ts:

- Do provide accurate information about the deceased trustee, including their full name and date of death.

- Do sign the affidavit in front of a notary public to validate the document.

- Do ensure that all required fields are completed before submitting the form.

- Do keep a copy of the completed affidavit for your records.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Don't use incorrect names or dates; double-check your entries.

- Don't forget to include any necessary supporting documents that may be required.

- Don't submit the form without reviewing it for errors.

Documents used along the form

The California Affidavit of Death of a Trustee form is a crucial document used in the process of transferring trust assets after a trustee has passed away. Along with this affidavit, several other forms and documents are often necessary to ensure a smooth transition of responsibilities and assets. Below is a list of these documents, each serving an important purpose in the estate management process.

- Trust Agreement: This document outlines the terms and conditions of the trust, including the roles of the trustee and beneficiaries. It is essential for understanding how the trust should be administered after the trustee's death.

- Death Certificate: A certified copy of the trustee's death certificate is typically required to validate the claim of death. This document serves as official proof needed for various legal processes.

- Notice of Death: This notice informs beneficiaries and interested parties of the trustee's passing. It may be required by law to ensure that all parties are aware of the change in trust management.

- Successor Trustee Acceptance Form: This document is signed by the successor trustee to formally accept their role in managing the trust. It confirms their willingness to take on the responsibilities outlined in the trust agreement.

- Certificate of Trust: This document summarizes key details about the trust, including its existence and the authority of the trustee. It can be used to provide information to banks or other institutions without disclosing the entire trust agreement.

- Notice to Quit: This form serves as a crucial legal document for landlords to communicate lease violations to tenants, also providing them an opportunity to address any issues before further actions are taken, including access to templates like https://floridaforms.net/blank-notice-to-quit-form/.

- Beneficiary Designation Forms: If the trust holds accounts or policies with designated beneficiaries, these forms may need to be updated to reflect the new trustee's authority to manage or distribute those assets.

Each of these documents plays a vital role in the administration of a trust following the death of a trustee. Ensuring that all necessary paperwork is in order can help avoid delays and complications during what is often a challenging time for families and beneficiaries.