Attorney-Approved Business Purchase and Sale Agreement Form

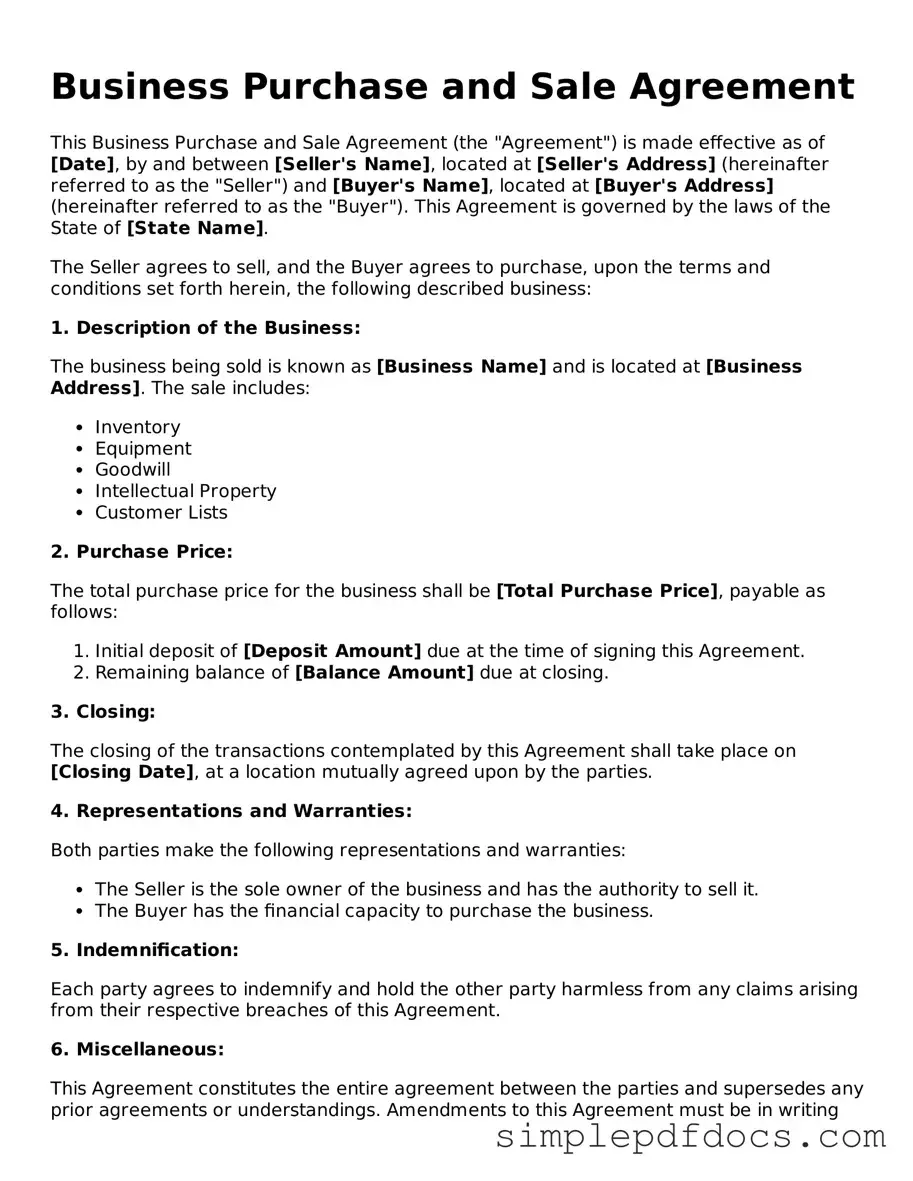

The Business Purchase and Sale Agreement form is a crucial document for individuals or entities engaged in the buying or selling of a business. This agreement outlines the terms and conditions under which the transaction will take place, providing clarity and protection for both parties involved. Key aspects of the form include details about the purchase price, payment terms, and the assets being transferred. It often specifies the responsibilities of the buyer and seller, including any warranties or representations made by the seller regarding the business's financial status and operations. Additionally, the form may address contingencies, such as financing or due diligence requirements, which must be satisfied before the sale is finalized. By establishing clear expectations, this agreement helps to minimize disputes and ensures a smoother transaction process for all parties concerned.

Check out Other Documents

Dd 214 - The character of service is explicitly stated, which can affect eligibility for veterans' programs.

The process of managing vehicle affairs can often feel overwhelming, especially for those who are unable to take care of transactions personally. To streamline this, individuals can utilize the Florida Vehicle POA form 82053, which grants authority to a trusted person for handling critical tasks. For those seeking more information on this essential document, Florida Forms provides comprehensive resources that can help facilitate the process efficiently.

Employee Release Form Template - This document reflects the company's commitment to showcasing its employees.

Child Travel Consent Form - Clarifies the responsible adult's authority while the child is away from their parents.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is sold and purchased. |

| Parties Involved | The agreement typically involves a seller, who is transferring ownership, and a buyer, who is acquiring the business. |

| Governing Law | The agreement is subject to the laws of the state in which the business operates. For example, in California, it is governed by California Commercial Code. |

| Key Components | Essential elements include purchase price, payment terms, representations and warranties, and conditions for closing the sale. |

| Due Diligence | Buyers often conduct due diligence to verify the business’s financial and operational status before finalizing the agreement. |

| Confidentiality | Many agreements include confidentiality clauses to protect sensitive information shared during the negotiation process. |

| Legal Counsel | It is advisable for both parties to seek legal counsel to ensure their interests are protected and the agreement is legally sound. |

How to Write Business Purchase and Sale Agreement

Filling out the Business Purchase and Sale Agreement form is an important step in finalizing the sale of a business. This document outlines the terms and conditions agreed upon by both the buyer and the seller. It is essential to complete it accurately to ensure that all parties are protected and that the transaction proceeds smoothly.

- Identify the Parties: Start by clearly stating the names and addresses of both the buyer and the seller. Make sure to include any business names if applicable.

- Describe the Business: Provide a detailed description of the business being sold. This includes the business name, type of business, and any relevant identification numbers.

- Outline the Purchase Price: Specify the total purchase price for the business. If there are any payment terms, such as deposits or financing arrangements, include those as well.

- List Included Assets: Clearly outline all the assets that are included in the sale. This might include equipment, inventory, intellectual property, and customer lists.

- State the Closing Date: Indicate the date when the sale will be finalized. This is often referred to as the "closing date."

- Detail Conditions of Sale: Note any conditions that must be met before the sale can proceed. This could involve inspections, financing approvals, or other contingencies.

- Include Representations and Warranties: Both parties should make certain representations and warranties about the business. This ensures that both sides are transparent about the state of the business.

- Signature Section: Provide space for both the buyer and seller to sign and date the agreement. This formalizes the contract and shows that both parties agree to the terms.

Once the form is filled out, it is advisable to review it carefully to ensure accuracy. After that, both parties should sign the agreement, and it may be beneficial to have it notarized for additional legal protection. Keeping a copy of the signed agreement is also essential for future reference.

Dos and Don'ts

When filling out a Business Purchase and Sale Agreement form, it is essential to approach the process with careful consideration. Below is a list of recommended practices and pitfalls to avoid.

- Do ensure all parties involved are clearly identified, including their legal names and addresses.

- Do provide a detailed description of the business being sold, including assets and liabilities.

- Do specify the purchase price and payment terms clearly to avoid misunderstandings.

- Do include any contingencies or conditions that must be met before the sale is finalized.

- Don't leave any sections blank; incomplete information can lead to disputes later.

- Don't rush through the process; take time to review each section carefully before submission.

Documents used along the form

When engaging in the process of buying or selling a business, several important documents accompany the Business Purchase and Sale Agreement. Each of these forms serves a specific purpose, ensuring that both parties understand their rights and obligations throughout the transaction. Below is a list of commonly used documents that are often associated with the Business Purchase and Sale Agreement.

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller before finalizing the purchase. It typically includes key terms such as price, payment structure, and any contingencies that must be met.

- Confidentiality Agreement: Also known as a non-disclosure agreement (NDA), this form protects sensitive information shared during the negotiation process. It ensures that proprietary information remains confidential, safeguarding the interests of both parties.

- Due Diligence Checklist: This checklist helps the buyer assess the business's financial, legal, and operational aspects. It outlines the documents and information that need to be reviewed, allowing the buyer to make an informed decision.

- Asset Purchase Agreement: If the transaction involves purchasing specific assets rather than the entire business entity, this agreement details the assets being sold, their valuation, and the terms of the transfer.

- Bill of Sale: This document serves as proof of the transfer of ownership of the business or its assets. It includes details about the transaction and is often required for legal and tax purposes.

- Tractor Bill of Sale: To ensure a seamless ownership transfer, utilize the accurate Georgia Tractor Bill of Sale form guide for proper documentation and compliance.

- Employment Agreements: These contracts outline the terms of employment for key personnel who will remain with the business post-sale. They help ensure a smooth transition and continuity of operations.

- Non-Compete Agreement: This agreement restricts the seller from starting a competing business within a certain timeframe and geographic area after the sale. It protects the buyer’s investment by preventing direct competition.

- Closing Statement: This document summarizes the financial aspects of the transaction at closing. It details the final costs, adjustments, and payments due, ensuring that all parties are clear about the financial outcomes of the sale.

Understanding these documents can significantly enhance the buying or selling experience. Each form plays a crucial role in protecting the interests of both the buyer and seller, ultimately leading to a smoother transaction process. It is advisable to consult with a professional to ensure that all necessary documents are properly prepared and executed.