Fill Your Business Credit Application Form

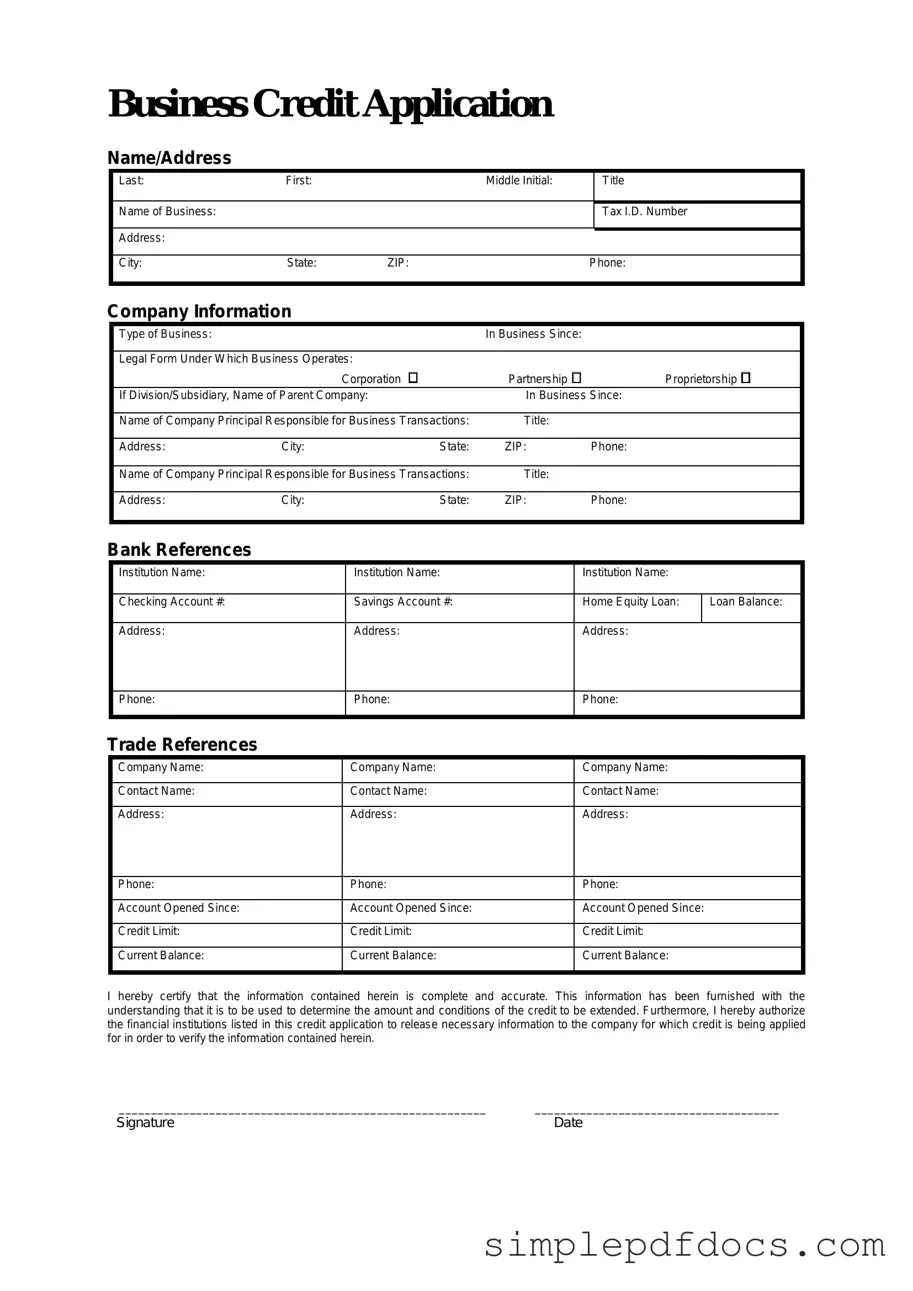

The Business Credit Application form serves as a critical tool for both lenders and businesses seeking credit. This form typically includes essential information such as the applicant's business name, address, and contact details, as well as the nature of the business and its ownership structure. Financial data, including revenue figures and existing debts, is often required to assess the applicant's creditworthiness. Additionally, the form may request personal guarantees from business owners, providing lenders with an extra layer of security. Terms of credit, such as desired credit limits and repayment terms, are also outlined, enabling both parties to establish clear expectations. By gathering this information, the Business Credit Application facilitates informed decision-making, helping lenders evaluate risk while allowing businesses to secure the necessary funding to grow and thrive.

More PDF Templates

How to File a Trespassing Order - This letter outlines the legal boundaries that must not be crossed.

How Long Do Credits Last for College - Don’t forget to provide your student ID number.

For those looking to document their transactions effectively, the "unique ATV Bill of Sale form" is invaluable. This form ensures that all pertinent details regarding the sale and transfer of ownership are appropriately recorded, facilitating a hassle-free exchange in compliance with local regulations. For more information, visit the unique ATV Bill of Sale form.

Form 10-2850c - The information gathered through the VA 10-2850c form is critical for matching applicants with suitable job openings.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from suppliers or financial institutions. |

| Information Required | Typically, the form requires details such as the business name, address, ownership structure, and financial information. |

| Creditworthiness Assessment | By submitting this form, businesses allow lenders to assess their creditworthiness based on the provided information. |

| State-Specific Variations | Some states may have specific requirements or forms, governed by local business and credit laws. |

| Privacy Considerations | Businesses should be aware that the information provided may be subject to privacy laws, protecting sensitive data. |

| Approval Process | After submission, the lender reviews the application, which may take several days to weeks for a decision. |

How to Write Business Credit Application

Filling out the Business Credit Application form is an important step in establishing a credit relationship with a lender or supplier. This process requires careful attention to detail to ensure all information is accurate and complete. Follow these steps to successfully fill out the form.

- Begin by entering your business name in the designated field.

- Provide the business address, including street, city, state, and ZIP code.

- List the type of business entity (e.g., corporation, LLC, sole proprietorship).

- Indicate the date your business was established.

- Include your federal tax identification number (EIN) or Social Security number if applicable.

- Provide the primary contact person’s name and their position in the company.

- Enter the contact person’s phone number and email address for correspondence.

- List the names of any owners or partners along with their ownership percentages.

- Detail your business’s annual revenue and the number of employees.

- Provide information about your business’s bank, including the bank name, branch location, and account number.

- List any trade references, including names, addresses, and contact information.

- Read through the terms and conditions carefully before signing the application.

- Sign and date the application at the bottom.

Once you have completed the form, review it for accuracy. Make sure all required fields are filled out and that the information is up to date. Submit the application as instructed, and keep a copy for your records.

Dos and Don'ts

When filling out a Business Credit Application form, attention to detail is crucial. Here are some guidelines to help you navigate the process smoothly.

- Do: Provide accurate and complete information. Every detail counts, so ensure that all fields are filled out correctly.

- Do: Double-check your financial statements. Make sure they are current and reflect your business's financial health.

- Do: Include references. Having a few business references can strengthen your application.

- Do: Be honest about your credit history. Transparency can build trust with lenders.

- Don't: Rush through the application. Taking your time can help prevent mistakes.

- Don't: Leave out any required documentation. Missing documents can delay the process or lead to rejection.

- Don't: Use vague language. Be clear and specific in your descriptions to avoid confusion.

Following these tips can enhance your chances of a successful application. Good luck!

Documents used along the form

When applying for business credit, a variety of documents may be required in addition to the Business Credit Application form. These documents help lenders assess the creditworthiness of the business and ensure that all necessary information is available for review. Below is a list of commonly used forms and documents that may accompany a credit application.

- Personal Guarantee: This document involves the business owner agreeing to be personally responsible for the debt if the business cannot repay it. It provides additional security for the lender.

- ATV Bill of Sale Form: For those involved in off-road vehicle transactions, the essential Arizona ATV Bill of Sale form provides crucial documentation to record ownership transfers.

- Business Plan: A comprehensive outline of the business's goals, strategies, and financial projections. This helps lenders understand the business's potential for growth and profitability.

- Financial Statements: These include balance sheets, income statements, and cash flow statements. They provide a snapshot of the business's financial health and performance over time.

- Tax Returns: Typically, lenders request the last two to three years of business tax returns. These documents help verify income and assess the business's tax obligations.

- Bank Statements: Recent bank statements offer insight into the business's cash flow and spending habits. They can also demonstrate the ability to manage finances effectively.

- Business License: A copy of the business license shows that the company is legally registered and authorized to operate in its respective industry.

- Articles of Incorporation: For corporations, this document outlines the company's structure and purpose. It is essential for verifying the legal existence of the business.

- Credit Report: A business credit report provides a detailed history of the business's credit activity. It helps lenders assess creditworthiness and risk.

- Resumes of Key Management: Providing resumes for key management personnel can demonstrate the experience and qualifications of those running the business, which can enhance lender confidence.

In conclusion, assembling these documents alongside the Business Credit Application form can significantly enhance the likelihood of securing credit. Each document plays a vital role in presenting a comprehensive picture of the business's financial stability and operational integrity.