Attorney-Approved Business Bill of Sale Form

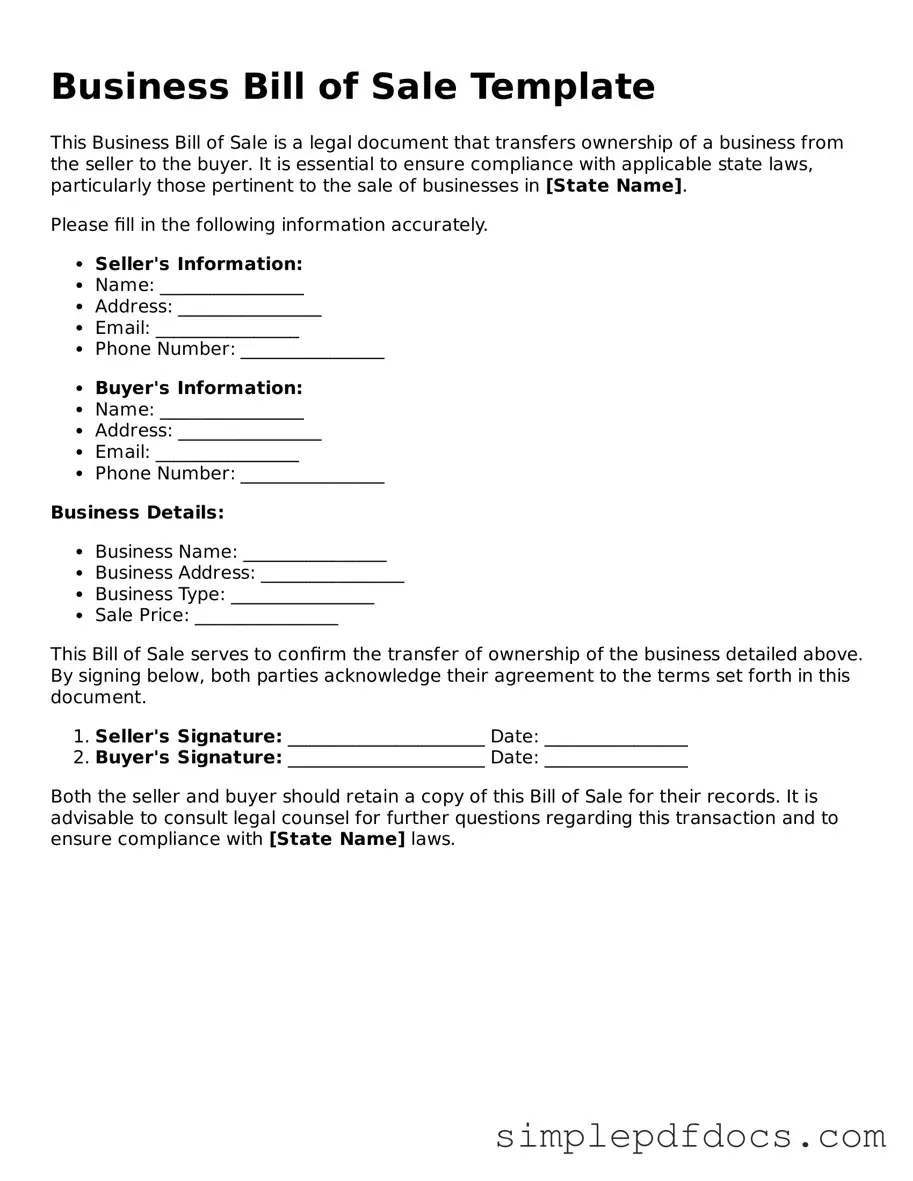

The Business Bill of Sale form serves as a critical document in the transfer of ownership of a business or its assets from one party to another. This form not only delineates the specifics of the transaction but also provides legal protection for both the seller and the buyer. Key elements typically included in the form are the names and contact information of the parties involved, a detailed description of the assets being sold, and the purchase price agreed upon. Additionally, the form may outline any warranties or representations made by the seller regarding the condition of the assets. By documenting the transaction in writing, the Business Bill of Sale helps to clarify the terms of the sale, ensuring that both parties have a mutual understanding of their rights and obligations. Furthermore, it may also include provisions related to liabilities, taxes, and any contingencies that must be met prior to the completion of the sale. In essence, this form is an essential tool that facilitates a smooth transition of ownership while safeguarding the interests of both parties involved.

More Business Bill of Sale Types:

Bill of Sale for Snowmobiles - A well-organized bill of sale can make future sales or transfers easier for the buyer down the line.

For anyone looking to create a comprehensive record of their transaction, the Bill of Sale is essential, and resources like NY Templates can provide valuable guidance to ensure all necessary details are included and accurately represented.

Bill of Sale Para Imprimir - It’s advisable to describe any defects or issues with the property in the form.

Free Motorcycle Bill of Sale - Records essential information about the sale and the motorcycle involved.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Business Bill of Sale is a legal document that transfers ownership of a business from one party to another. |

| Purpose | This form serves to protect both the buyer and seller by documenting the transaction and its terms. |

| Governing Laws | The laws governing a Business Bill of Sale vary by state. For example, in California, it is governed by the California Commercial Code. |

| Essential Elements | Key components include the names of the buyer and seller, a description of the business, and the purchase price. |

| Signatures | Both parties must sign the document to make it legally binding, often in the presence of a witness or notary. |

How to Write Business Bill of Sale

After obtaining the Business Bill of Sale form, you will need to complete it accurately. This document is essential for transferring ownership of a business. Follow these steps to ensure all necessary information is provided.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name of the seller. Include any relevant business name if applicable.

- Enter the seller's contact information, including address, phone number, and email.

- List the full name of the buyer, along with their contact information.

- Describe the business being sold. Include details such as the business name, type, and location.

- Specify the purchase price. Clearly state the amount in both numerical and written form.

- Include the payment method. Indicate whether it is cash, check, or another form.

- Provide any additional terms of the sale, if applicable. This may include warranties or conditions.

- Both the seller and buyer should sign and date the form at the bottom.

Once completed, review the form for accuracy before submitting it. Ensure that both parties retain a copy for their records.

Dos and Don'ts

When filling out the Business Bill of Sale form, it's important to approach the task with care and attention to detail. Below are some guidelines to help ensure a smooth process.

- Do: Ensure all information is accurate and complete before submitting the form.

- Do: Clearly identify the parties involved, including full names and contact information.

- Do: Include a detailed description of the business being sold, including any assets or liabilities.

- Do: Review the form for any errors or omissions before finalizing it.

- Don't: Leave any fields blank; incomplete forms may lead to delays.

- Don't: Use vague language; specificity helps prevent misunderstandings.

By following these guidelines, you can help ensure that the Business Bill of Sale form is filled out correctly and efficiently.

Documents used along the form

When engaging in the sale of a business, several documents complement the Business Bill of Sale form to ensure a smooth transaction. Each document serves a specific purpose, helping to clarify the terms of the sale and protect the interests of both the buyer and the seller. Below are four important forms often used alongside the Business Bill of Sale.

- Purchase Agreement: This document outlines the terms and conditions of the sale, including the purchase price, payment terms, and any contingencies. It serves as a comprehensive contract that both parties must agree to before finalizing the sale.

- Asset List: An asset list details all the tangible and intangible assets being sold as part of the business. This can include equipment, inventory, intellectual property, and customer lists. Having a clear asset list helps prevent disputes over what is included in the sale.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared during the negotiation process. It ensures that both parties keep proprietary information confidential, which is crucial for maintaining business integrity and competitive advantage.

- Bill of Sale for Personal Property: This document is essential for transferring ownership of personal property in Texas. For more details, you can check out the https://txtemplate.com/bill-of-sale-pdf-template.

- Transfer of Ownership Documents: These documents facilitate the legal transfer of ownership of the business entity itself. Depending on the structure of the business, this may include stock transfer forms for corporations or membership interest transfer agreements for LLCs.

Using these documents in conjunction with the Business Bill of Sale can help streamline the sale process and minimize potential legal issues. Each form plays a vital role in ensuring that the transaction is clear, fair, and legally binding.