Fill Your Broker Price Opinion Form

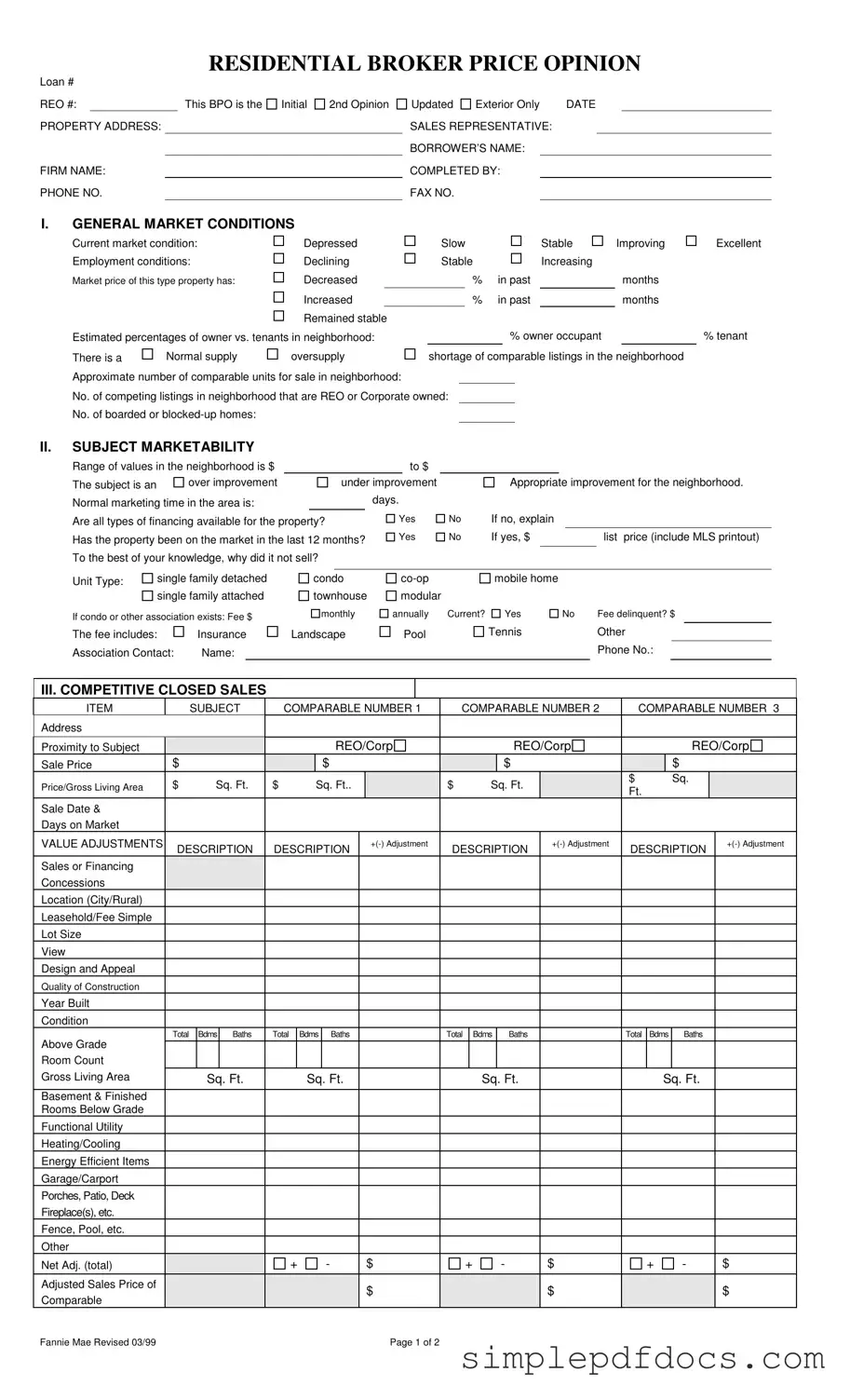

The Broker Price Opinion (BPO) form serves as a crucial tool in the real estate industry, particularly for assessing property values in various market conditions. It is designed to provide a comprehensive analysis of a property’s worth based on current market trends, comparable sales, and specific property characteristics. The form includes sections that detail general market conditions, such as employment rates and the supply of comparable listings, which influence property values. Additionally, it addresses the subject property’s marketability, indicating whether it is over- or under-improved relative to local standards. Buyers and sellers alike benefit from insights into the competitive landscape, including closed sales data and active listings. The BPO also outlines potential repairs needed to enhance marketability, thereby informing strategic marketing decisions. Ultimately, this form synthesizes critical information to guide stakeholders in making informed decisions regarding real estate transactions.

More PDF Templates

What Is Net Spend - Expect thorough documentation needs when filing the dispute for efficient processing.

For landlords in Florida, utilizing the Notice to Quit form is essential in managing tenant relationships effectively. By serving this notice, landlords can address lease violations and communicate their intent not to renew a tenancy, giving tenants a chance to correct their actions within a set timeframe. To access a suitable template for this process, you can visit floridaforms.net/blank-notice-to-quit-form/, ensuring that all necessary legal steps are followed properly.

Medicare Abn 2024 - The form is not a guarantee of coverage but an alert about potential issues with coverage.

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose of BPO | A Broker Price Opinion (BPO) is used to estimate the value of a property, often for lenders or real estate agents assessing market conditions. |

| Components of the Form | The BPO form includes sections for general market conditions, subject property marketability, competitive closed sales, and marketing strategy. |

| Market Conditions | It assesses current market conditions, including employment rates and property pricing trends, to provide a comprehensive view of the market. |

| Financing Availability | The form inquires whether all types of financing are available for the property, which can significantly impact its marketability. |

| Competitive Listings | It compares the subject property to similar properties in the area, providing a basis for determining a competitive price. |

| State-Specific Laws | In states like California, BPOs must comply with the California Business and Professions Code, which governs real estate practices. |

How to Write Broker Price Opinion

Filling out the Broker Price Opinion (BPO) form is a straightforward process that requires attention to detail. This form helps in assessing the value of a property based on various market factors and comparable sales. Below are the steps to complete the BPO form accurately.

- Begin by entering the Loan # and REO # at the top of the form.

- Fill in the PROPERTY ADDRESS, FIRM NAME, and PHONE NO..

- Select the appropriate option for Initial, 2nd Opinion, or Updated and indicate if it is Exterior Only.

- Enter the DATE and the name of the SALES REPRESENTATIVE.

- Provide the BORROWER’S NAME and the name of the person COMPLETED BY.

- Fill in the FAX NO. if applicable.

- In the GENERAL MARKET CONDITIONS section, assess the current market condition and employment conditions. Select the appropriate options.

- Indicate the estimated percentages of owner vs. tenants in the neighborhood.

- Provide information on the supply of comparable listings and the approximate number of units for sale.

- In the SUBJECT MARKETABILITY section, enter the range of values and the marketing time in days.

- Answer whether all types of financing are available for the property. If no, provide an explanation.

- Indicate if the property has been on the market in the last 12 months and list the price.

- Specify the Unit Type and fill out information regarding any associations, including fees.

- Move to the COMPETITIVE CLOSED SALES section. Fill in details for at least three comparable properties, including their addresses, sale prices, and adjustments.

- Document any repairs needed and the most likely buyer type in the REPAIRS section.

- In the COMPETITIVE LISTINGS section, provide details for comparable listings, including their list prices and adjustments.

- Finally, assess the MARKET VALUE and provide comments on the property, including any specific concerns.

- Sign and date the form at the bottom.

Dos and Don'ts

When filling out the Broker Price Opinion form, it’s essential to be thorough and accurate. Here are some key dos and don’ts to keep in mind:

- Do provide complete and accurate property details.

- Do assess current market conditions honestly.

- Do include all necessary comparisons with similar properties.

- Do note any repairs needed to enhance marketability.

- Don't leave any sections blank unless instructed.

- Don't exaggerate property values or conditions.

- Don't overlook the importance of accurate contact information.

- Don't forget to include comments on any unique property concerns.

Documents used along the form

The Broker Price Opinion (BPO) form serves as a critical tool for assessing the value of a property, particularly in real estate transactions. Alongside the BPO, several other documents are commonly utilized to provide a comprehensive overview of the property’s status and market conditions. The following list outlines these documents and their respective purposes.

- Comparative Market Analysis (CMA): This document compares the subject property to similar properties that have recently sold in the area. It helps to establish a fair market value based on current market conditions and comparable sales.

- Appraisal Report: An appraisal report is a professional assessment conducted by a licensed appraiser. It provides an unbiased estimate of a property's value based on various factors, including location, condition, and comparable sales.

- Commercial Lease Agreement: A Florida Commercial Lease Agreement outlines the terms and conditions under which a property owner leases commercial space to a tenant. Important details like rental amount, duration of the lease, and responsibilities of both parties must be clearly defined. For more information, you can refer to Florida Forms.

- Property Condition Report: This report details the physical condition of the property, highlighting any repairs or improvements needed. It serves to inform potential buyers about the state of the property and any associated costs.

- Listing Agreement: A listing agreement is a contract between the property owner and a real estate broker. It outlines the terms under which the broker will market and sell the property, including commission rates and duration of the agreement.

- Disclosure Statements: Disclosure statements provide essential information about the property, including any known issues or defects. They are crucial for transparency and help protect both buyers and sellers during the transaction process.

- Marketing Plan: A marketing plan outlines the strategies that will be employed to sell the property. It includes target demographics, advertising methods, and pricing strategies, ensuring that the property is effectively promoted to potential buyers.

These documents, when used in conjunction with the Broker Price Opinion form, create a well-rounded picture of the property’s marketability and value. Each plays a unique role in facilitating informed decision-making for all parties involved in the real estate transaction.