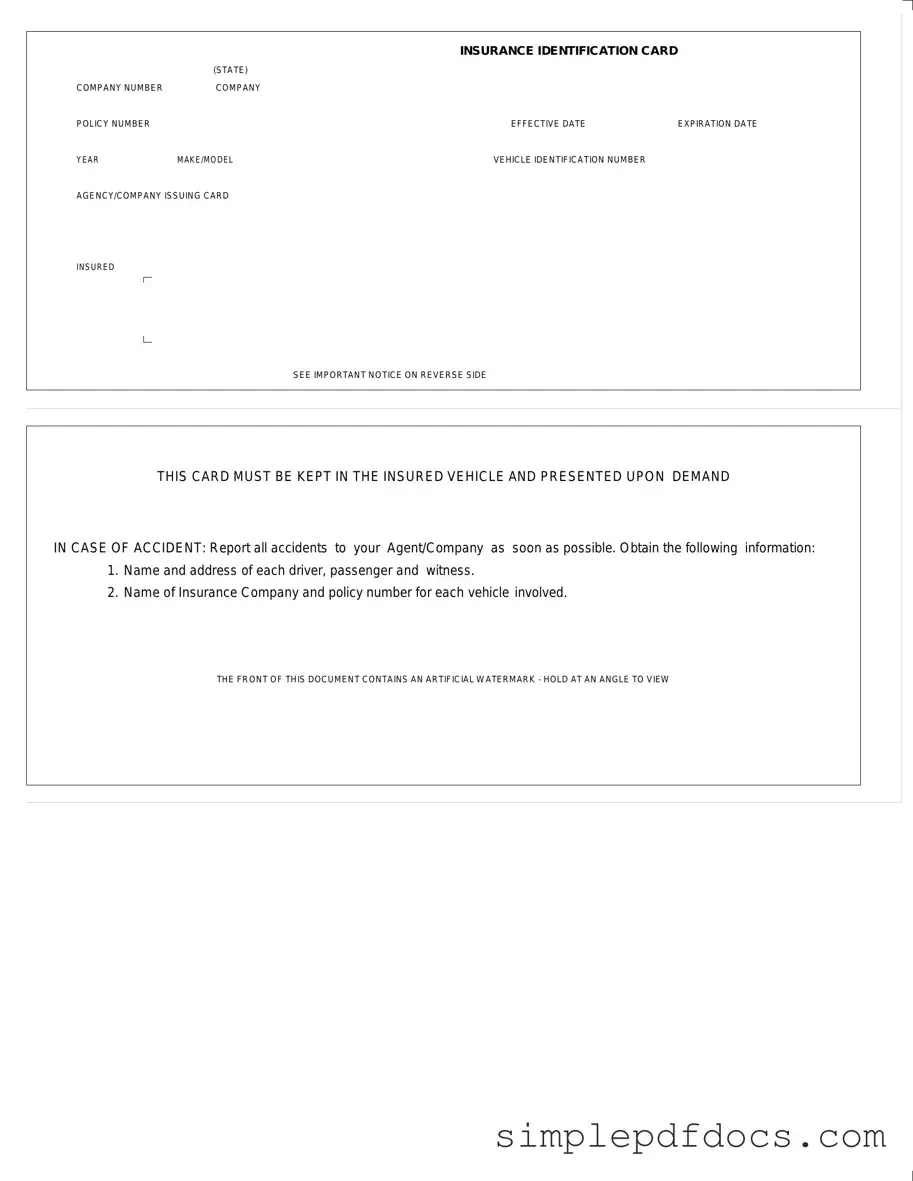

Fill Your Auto Insurance Card Form

The Auto Insurance Card is a crucial document for vehicle owners, serving as proof of insurance coverage. This card includes essential details such as the insurance company number, policy number, effective and expiration dates, and the vehicle's make, model, and identification number. It is issued by the insurance agency and must be kept in the insured vehicle at all times. In the event of an accident, the card should be presented upon demand. Additionally, it is important to report any accidents to your insurance agent or company promptly. Collecting information from all parties involved, including names and addresses of drivers, passengers, and witnesses, is vital for a smooth claims process. Notably, the front of the card features an artificial watermark, which can be seen by holding it at an angle, further ensuring its authenticity. Always refer to the important notice on the reverse side for additional guidance and requirements.

More PDF Templates

Partial Waiver of Lien Chicago Title - The form explicitly states that all claims to labor or materials are relinquished upon payment receipt.

Understanding the nuances of the FR-44 Florida form is crucial for drivers in Florida, as it directly impacts their ability to maintain legal driving status. This document, required by the Financial Responsibility Law, ensures compliance with the state's insurance coverage mandates. To further assist in navigating this process, you can find additional resources and information through Florida Forms, which provides detailed guidance on completing and submitting the necessary paperwork.

Making a Family Crest - Coats of Arms serve as a way to educate future generations about their heritage and values.

Acord 130 - The Acord 130 form is a crucial application for workers' compensation insurance.

Document Specifics

| Fact Name | Description |

|---|---|

| Document Title | This form is officially titled the "Insurance Identification Card (State)". |

| Company Number | The card includes a unique company number assigned by the insurance provider. |

| Policy Number | A specific policy number is provided, linking the card to the insured's coverage. |

| Effective Date | The card lists the effective date, indicating when the insurance coverage begins. |

| Expiration Date | The expiration date shows when the insurance coverage ends, requiring renewal. |

| Vehicle Information | Details such as the year, make, and model of the vehicle are included for identification. |

| VIN | The Vehicle Identification Number (VIN) is provided to uniquely identify the vehicle. |

| Issuing Agency | The name of the agency or company that issued the card is clearly stated. |

| Legal Requirement | In many states, it is required by law to keep this card in the vehicle at all times. |

| Accident Reporting | The card advises the insured to report all accidents to their agent or company promptly. |

How to Write Auto Insurance Card

To complete the Auto Insurance Card form, gather the necessary information about your vehicle and insurance policy. This information will ensure that your card is accurate and meets state requirements. Follow these steps carefully to fill out the form correctly.

- Locate the INSURANCE IDENTIFICATION CARD section at the top of the form.

- In the COMPANY NUMBER field, enter the identification number assigned to your insurance company.

- Next, fill in the COMPANY POLICY NUMBER with your specific policy number.

- For the EFFECTIVE DATE, provide the date your insurance coverage begins.

- In the EXPIRATION DATE field, indicate when your insurance coverage will end.

- Enter the YEAR of your vehicle, followed by the MAKE/MODEL of the vehicle.

- In the VEHICLE IDENTIFICATION NUMBER section, input the unique VIN assigned to your vehicle.

- Identify the AGENCY/COMPANY ISSUING CARD by writing the name of the insurance agency or company that provided the card.

Once you have completed all the fields, review the information to ensure accuracy. Keep the card in your vehicle, as it must be presented upon request in case of an accident. Remember to report any accidents to your insurance agent as soon as possible.

Dos and Don'ts

When filling out your Auto Insurance Card form, it's crucial to get it right. Here’s a guide on what to do and what to avoid:

- Do double-check all information for accuracy before submitting.

- Don't leave any fields blank; each section is important.

- Do ensure that the effective and expiration dates are clearly marked.

- Don't use abbreviations that might confuse the reader.

- Do write legibly to avoid any misunderstandings.

- Don't forget to include the vehicle identification number (VIN).

- Do keep a copy of the completed form for your records.

- Don't ignore the instructions on the reverse side of the card.

- Do present the card upon demand in case of an accident.

By following these guidelines, you can help ensure that your auto insurance card is filled out correctly and is ready for any situation that may arise.

Documents used along the form

When you own a vehicle, several important documents accompany your Auto Insurance Card. Each of these documents serves a specific purpose, ensuring that you are prepared for various situations related to vehicle ownership and insurance. Here’s a list of common forms and documents that you may need to keep handy alongside your Auto Insurance Card.

- Vehicle Registration: This document proves that you are the legal owner of the vehicle. It contains details such as the vehicle's make, model, year, and identification number. You must keep this document in your vehicle at all times.

- Driver’s License: A valid driver’s license is necessary to legally operate a vehicle. It includes your personal information and serves as proof of your ability to drive.

- Proof of Purchase: This document, often a bill of sale, confirms your ownership of the vehicle. It is particularly important when registering the vehicle or if you need to provide evidence of ownership.

- Title: The title is a legal document that establishes ownership of the vehicle. It includes details about any liens against the vehicle and is necessary for selling or transferring ownership.

- Florida Quitclaim Deed Form: A legal document used to transfer interest in real estate with no guarantees about the title. It can be found here: https://floridaforms.net/blank-quitclaim-deed-form/.

- Inspection Certificate: Depending on your state, an inspection certificate may be required to confirm that your vehicle meets safety and emissions standards. This document must be renewed periodically.

- Maintenance Records: Keeping records of your vehicle’s maintenance can help prove that you have taken good care of your vehicle. This is useful for resale and can also be beneficial in case of disputes with insurance companies.

- Accident Report Form: In the event of an accident, this form allows you to document details such as location, time, and circumstances. Having a completed report can help streamline the claims process.

- Claim Form: If you need to file a claim with your insurance company, this form is essential. It provides necessary information about the incident and the damages incurred.

- Roadside Assistance Card: If you have roadside assistance as part of your insurance or through a separate service, this card provides the necessary contact information and coverage details in case of emergencies.

Keeping these documents organized and easily accessible can save you time and stress in various situations. Always ensure that they are up to date and stored securely in your vehicle. Being prepared is key to responsible vehicle ownership.