Fill Your Adp Pay Stub Form

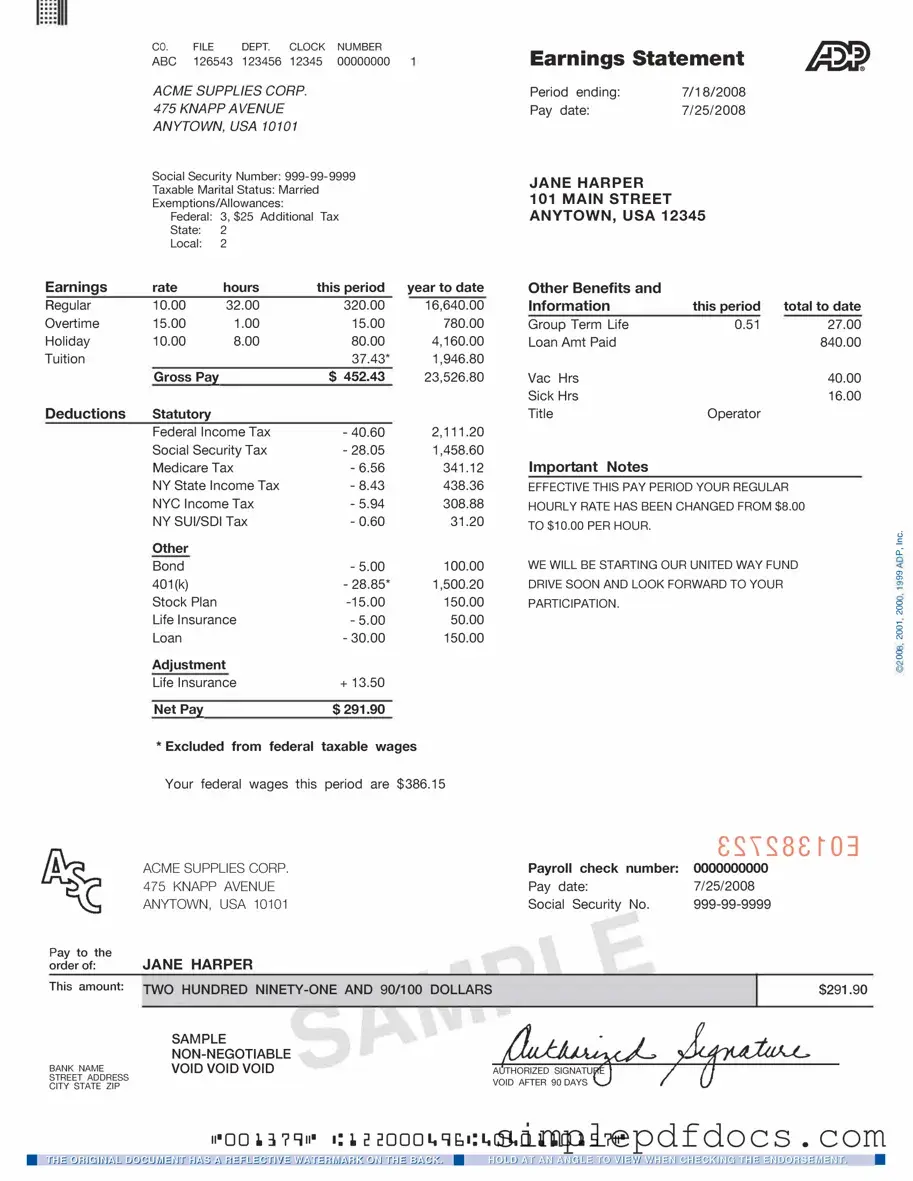

The ADP Pay Stub form is an essential document for employees and employers alike, providing a clear and concise breakdown of earnings and deductions for each pay period. This form typically includes crucial information such as the employee's gross pay, net pay, and various deductions for taxes, retirement contributions, and health insurance. Additionally, it offers insights into hours worked, overtime, and any bonuses or commissions earned, ensuring transparency in the payment process. Understanding the details on the pay stub can help employees manage their finances more effectively, while employers can use it to maintain accurate payroll records. By familiarizing oneself with the components of the ADP Pay Stub form, individuals can better navigate their financial responsibilities and rights related to their employment compensation.

More PDF Templates

Dmv Odometer Disclosure Statement - The penalties for providing false odometer information can be severe.

This vital document serves as a guideline on various workplace protocols and assists in ensuring a smooth operation within your team. For further insights, explore our informative "key points for your Employee Handbook forms" by visiting the following link: Employee Handbook.

When to File 1099-nec - Payments totaling $600 or more require the issuance of this form to the recipient.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings, deductions, and net pay for a specific pay period. |

| Components | The pay stub typically includes employee information, pay period dates, gross pay, taxes withheld, and other deductions such as health insurance or retirement contributions. |

| Frequency | Employees receive the ADP Pay Stub form on a regular basis, usually coinciding with their pay schedule—weekly, bi-weekly, or monthly. |

| Accessibility | ADP offers both physical and electronic versions of the pay stub, allowing employees to access their information conveniently through online portals. |

| State-Specific Regulations | In states like California, employers must provide itemized wage statements as per California Labor Code Section 226, which governs the information included in pay stubs. |

| Importance for Employees | The pay stub serves as an essential document for employees, helping them understand their earnings, prepare for tax filing, and verify that deductions are accurate. |

How to Write Adp Pay Stub

Filling out the ADP Pay Stub form is an important step for employees to ensure accurate record-keeping of their earnings and deductions. This form provides essential information about your pay period, gross earnings, and any withholdings. Follow these steps to complete the form accurately.

- Start by entering your personal information at the top of the form. This includes your name, address, and employee ID number.

- Next, indicate the pay period dates. Make sure to specify the start and end dates clearly.

- Fill in the gross earnings section. This is the total amount you earned before any deductions.

- List any deductions that apply to your paycheck. Common deductions include taxes, retirement contributions, and health insurance premiums.

- Calculate your net pay by subtracting total deductions from gross earnings. Write this amount in the designated section.

- Review all the information for accuracy. Ensure that numbers are clear and legible.

- Finally, sign and date the form to confirm that the information is correct.

Dos and Don'ts

When filling out the ADP Pay Stub form, it is crucial to pay attention to detail. Here is a list of things you should and shouldn't do:

- Do: Double-check your personal information for accuracy.

- Do: Use clear and legible handwriting or type your information.

- Do: Include all relevant income sources and deductions.

- Do: Review the form for any missing signatures or dates.

- Don't: Rush through the process; take your time to ensure accuracy.

- Don't: Leave any sections blank; fill out all required fields.

- Don't: Ignore any instructions provided with the form.

By following these guidelines, you can help ensure that your ADP Pay Stub form is completed correctly and efficiently.

Documents used along the form

The ADP Pay Stub form is a crucial document for employees to understand their earnings and deductions. Several other forms and documents are often used in conjunction with the pay stub to provide a comprehensive view of an employee's financial situation. Below is a list of related documents that may be important for record-keeping and financial planning.

- W-2 Form: This form summarizes an employee's annual wages and the taxes withheld. Employers must provide it by January 31 each year for tax filing purposes.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their pay directly into their bank account. It includes bank account details and must be completed before the first direct deposit.

- Pay Schedule: This document outlines when employees will receive their paychecks. It can be weekly, bi-weekly, or monthly, and helps employees plan their finances accordingly.

- Bill of Sale Form: A legal document that records the transfer of ownership of personal property from one person to another, serving as proof of purchase. For templates, you can check Fast PDF Templates.

- Tax Withholding Certificate (W-4): Employees use this form to indicate their tax situation to their employer. It helps determine the amount of federal income tax withheld from their paychecks.

These documents work together to ensure employees have a clear understanding of their earnings, deductions, and tax obligations. Keeping them organized can help in managing finances effectively.