Fill Your 14653 Form

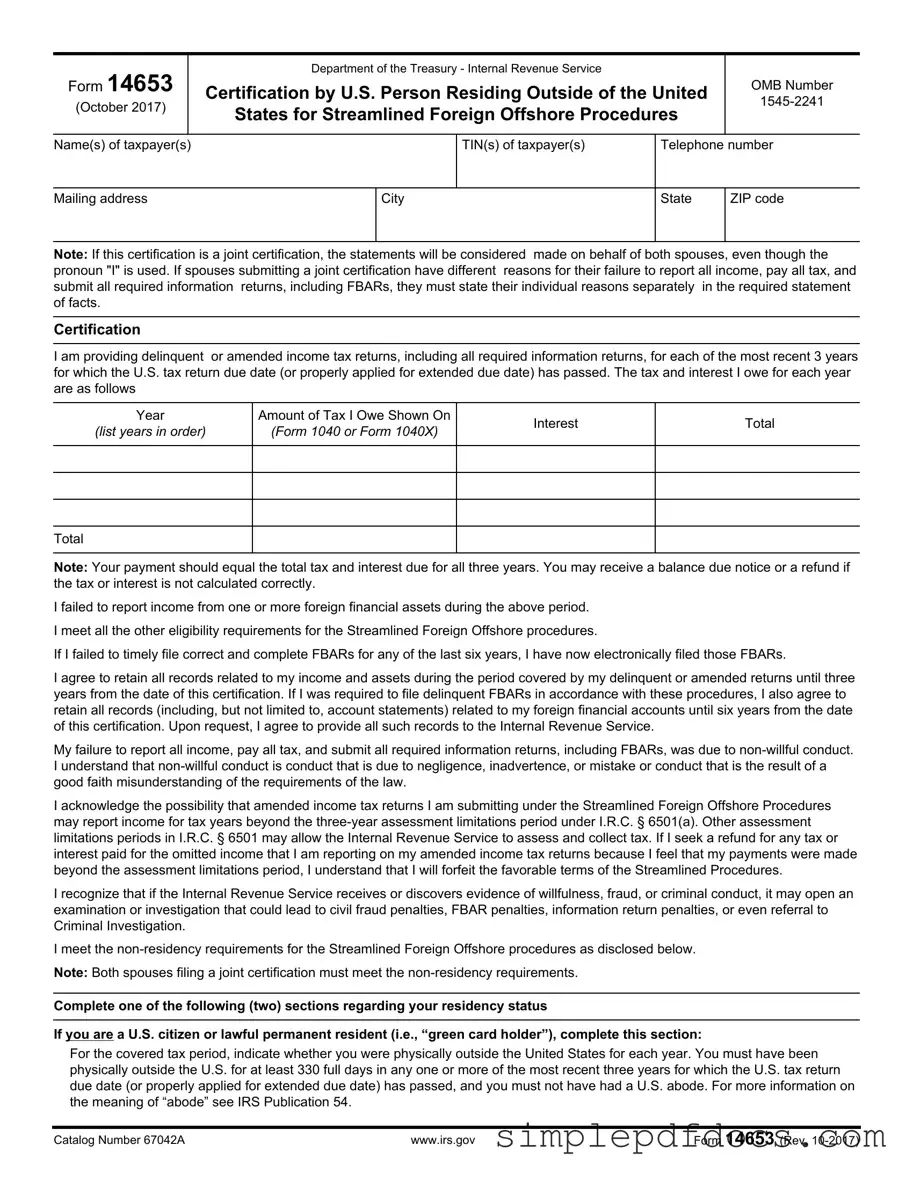

The 14653 form serves a critical role for U.S. persons residing outside the United States who need to comply with tax obligations through the Streamlined Foreign Offshore Procedures. This form is designed for individuals who have failed to report income, pay taxes, or submit required information returns, including Foreign Bank Account Reports (FBARs). By submitting this certification, taxpayers can rectify their tax status while demonstrating that their failures were due to non-willful conduct, such as negligence or misunderstanding of the law. The form requires detailed information, including the taxpayer's name, Tax Identification Number (TIN), and contact information, as well as a comprehensive statement of facts explaining the reasons for the tax noncompliance. Taxpayers must also provide delinquent or amended income tax returns for the past three years, along with any applicable tax and interest amounts owed. Furthermore, the form emphasizes the importance of maintaining records related to foreign financial accounts for specified periods, underscoring the IRS's authority to assess taxes and penalties if willful conduct is suspected. By understanding the nuances of the 14653 form, individuals can take proactive steps to resolve their tax issues and avoid potential legal consequences.

More PDF Templates

Miscellaneous Information - Payees receiving 1099-MISC forms should review them for accuracy before filing taxes.

The Florida Marriage Application form is a crucial document for couples planning to marry in the state of Florida. This form serves as the initial step in obtaining a marriage license, which is valid for only 60 days. For those seeking more information, resources such as Florida Forms can provide valuable guidance. Understanding the requirements and limitations of this application is essential for a smooth wedding planning process.

Why Does Fedex Need a Signature - Each package you wish to authorize requires a separate form.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | Form 14653 is used by U.S. persons residing outside the United States to certify eligibility for the Streamlined Foreign Offshore Procedures. |

| Eligibility Requirements | Taxpayers must provide delinquent or amended income tax returns for the last three years and meet specific residency criteria. |

| Non-Willful Conduct | The form requires taxpayers to declare that their failure to report income was due to non-willful conduct, which includes negligence or misunderstanding of tax laws. |

| Retention of Records | Taxpayers must retain all records related to income and foreign financial accounts for three to six years, depending on the circumstances. |

| Governing Law | This form is governed by Internal Revenue Code sections including I.R.C. § 6501 and I.R.C. § 7701(b)(3). |

How to Write 14653

Completing Form 14653 is a crucial step for individuals seeking to address their tax obligations under the Streamlined Foreign Offshore Procedures. This form requires careful attention to detail and accurate reporting of your financial history. Below are the steps to guide you through the process of filling out this important document.

- Gather Required Information: Collect your taxpayer identification number (TIN), mailing address, and contact information. Ensure you have details about your income tax returns for the past three years.

- Identify Tax Years: List the years for which you are submitting delinquent or amended returns. Make sure to include the amount of tax owed and any interest for each year.

- Provide Residency Status: Indicate whether you were physically outside the United States for at least 330 full days during the relevant years. If applicable, complete the section for non-U.S. citizens or lawful permanent residents.

- Explain Reasons for Non-Compliance: Write a detailed narrative explaining your failure to report income, pay taxes, or submit required returns. Include personal and financial background, as well as the source of funds in foreign accounts.

- Sign and Date the Form: Ensure that you and your spouse (if applicable) sign and date the certification. If you are a fiduciary, include your title and name as well.

- Review for Completeness: Double-check that all sections are filled out accurately and that the narrative statement of facts is included. Incomplete submissions may be rejected.

- Submit the Form: Send the completed Form 14653 to the appropriate IRS address as specified in the instructions. Keep a copy for your records.

Following these steps will help ensure that your submission is complete and meets IRS requirements. Timely and accurate filing is essential to avoid complications in your tax compliance process.

Dos and Don'ts

When filling out Form 14653, it’s essential to follow certain guidelines to ensure your submission is complete and accurate. Here’s a helpful list of what to do and what to avoid:

- Do: Provide accurate and complete information for each section of the form.

- Do: Include a detailed narrative statement explaining your failure to report all income and submit required returns.

- Do: Ensure that both spouses meet the non-residency requirements if filing jointly.

- Do: Retain all relevant records related to your income and assets for the required time periods.

- Do: Double-check your calculations for tax and interest owed before submission.

- Don't: Submit the form without a complete narrative statement of facts; it will be considered incomplete.

- Don't: Forget to attach any necessary computations if you are not a U.S. citizen or lawful permanent resident.

- Don't: Provide vague or insufficient reasons for your failure to report income; specifics are crucial.

- Don't: Leave out any required signatures; both taxpayers must sign if filing jointly.

- Don't: Assume that the IRS will automatically understand your situation without clear explanations.

Documents used along the form

When completing Form 14653, there are several additional documents that may be necessary to support your submission. These documents help clarify your situation and provide the Internal Revenue Service (IRS) with the information needed to process your request efficiently. Below is a list of commonly used forms and documents that often accompany Form 14653.

- Form 1040: This is the standard individual income tax return form used to report your annual income, claim tax deductions and credits, and calculate your tax refund or amount owed.

- Form 1040X: This form is used for amending a previously filed tax return. If you need to correct errors on your Form 1040, this is the document to submit.

- FBAR (FinCEN Form 114): The Foreign Bank Account Report is required if you have foreign financial accounts exceeding certain thresholds. It reports foreign bank accounts to the U.S. Treasury.

- Form 8938: This form is used to report specified foreign financial assets. It is required for certain taxpayers who have an interest in foreign assets exceeding specific thresholds.

- IRS Publication 54: This publication provides guidance on tax issues for U.S. citizens and resident aliens living abroad. It can help clarify residency requirements and tax obligations.

- Statement of Facts: A detailed narrative explaining your reasons for failing to report income or file returns. This should include your personal and financial background, as well as any relevant circumstances.

- Power of Attorney Form: A key legal document that empowers individuals to act on behalf of another, including making crucial financial and health-related decisions. For more information, visit https://floridaforms.net/blank-power-of-attorney-form/.

- Proof of Residency: Documentation that verifies your physical presence outside the U.S. for the required number of days, such as travel itineraries or foreign residency permits.

- Advisory Letters: If you relied on professional advice regarding your tax situation, include any letters or correspondence from your tax advisor that support your claims.

- Bank Statements: Statements from your foreign bank accounts may be required to substantiate your claims regarding income and asset reporting.

- W-2 and 1099 Forms: These forms report income from employment and other sources. Including them helps verify your income for the years in question.

Gathering these documents can significantly enhance your submission's clarity and completeness. Properly preparing your application with the right supporting materials can facilitate a smoother process with the IRS, potentially leading to quicker resolution and compliance with tax obligations.